Today, there exist several thousands of cryptocurrencies and the market value of all these coins has recently broken the two-trillion-dollar mark. Central banks are addressing the issue, the general public is discussing its pros and cons, and current price fluctuations have become part of mainstream news. All of this serves as undeniable evidence that cryptocurrencies have become much more significant than their creators had likely ever imagined some 15 years ago. But how did this technological innovation actually come about – who were the people behind this project, what was their motivation, and how did all of this unfold? In line with the notion that, in order to understand the present, one must understand the past, we’d like to share the story of Bitcoin & Co in a small series of articles here on the BISON blog. Part one dealt with the early days of cryptocurrencies through to the emergence of Bitcoin. Part two was about the beginnings of transactions and crypto exchanges, bitcoin bubbles, and altcoin. Part three talks about the bear market, the block size dispute, and the second halving.

2013: Bitcoin Ban in China

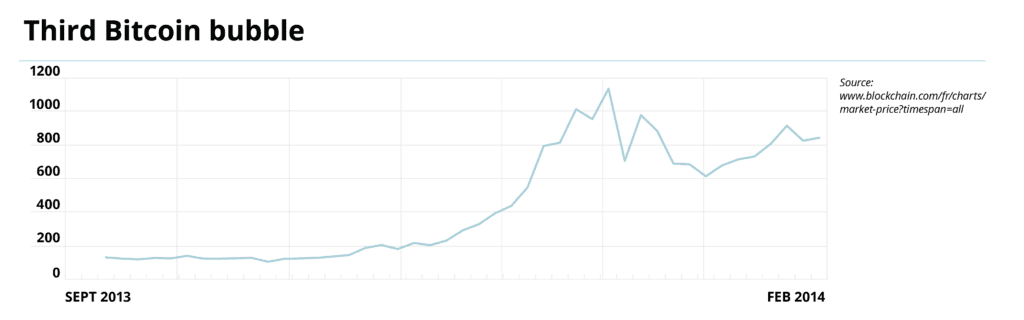

In 2013, Bitcoin was on the rise and, by autumn, China also discovered enthusiasm for the cryptocurrency. Companies accepted Bitcoin and even the Chinese state television reported positively about the digital currency. China was quick to recognize the value of Bitcoin as a scarce commodity. Trading activity in the vast Chinese market led to a surge in the trading of Bitcoin and the altcoin in 2013. In September, the price initially climbed to 110 USD, in October to 180 USD, and finally even to 1,000 USD in November.

Just in time for Black Friday sales at the end of November, online stores accepted Bitcoin as a means of payment. Never before had so many people paid for their orders with cryptocurrency as on that Friday. The craze for Bitcoin also affected the exchange rate, which jumped to 1,260 USD. Bitcoin was now more valuable than 1 ounce of gold. That day went down in history as “Bitcoin Black Friday.”

As is usual with bubbles, this one also eventually burst. Just a few days later after the new all-time high, on December 5th, the price fell and lost almost half of its value. The reason for this was Chinese regulations: the Chinese central bank had banned financial institutions in the country from trading cryptocurrencies.

2013: „I AM HODLING.“

On December 18th, 2013, the BitCoinTalk forum user “GameKyuubi” became a legend. He published a post with the title: “I AM HODLING”. The then drunk software developer actually wanted to write “holding”.1 His intention was to publicly announce that he would hold his Bitcoin and that the cryptocurrency needed continued support. In the crypto world, “hodling” has become a fixed term for “keeping a cryptocurrency in its upcoming growth.2

2014: Downfall of the Crypto Exchange Mt. Gox

Mt. Gox, one of the largest crypto exchanges of that time, had been in a state of crisis for a while. The US Securities and Exchange Commission froze Mt. Gox’s bank accounts, delaying dollar withdrawals. In February, the exchange’s capacity was no longer sufficient for customers’ large bitcoin holdings, leading it to halt bitcoin withdrawals as well. In a press release on February 28th, 2014, Mark Karpelès, CEO von Mt. Gox, declared that all bitcoin was lost.

A video began to circulate: the Brit Kolin Burges had flown from London to Tokyo to wait for Karpelès in front of the entrance to the exchange’s office and personally ask him for his Bitcoin. In his hand, he held a sign that read, “Mt. Gox, where is our money.”

The total failure of the Mt. Gox crypto exchange launched the bear market. Over the course of a year, prices fell, investments declined, and companies went bankrupt.

2014: Failure to Succeed

The year 2014 could be put under the headline “Euphoria and investments – but not much success for cryptocurrencies”. Although Bitcoin’s acceptance by large companies and investors had increased, the price continued to plummet. From about 900 USD in January 2014, the price fell to about 200 USD in January 2015.4 The media reported that Bitcoin was either dead or would “slowly but surely disintegrate”. (Bergmann, C. (2019), p. 214 cited by London New Statesman).

Other cryptocurrencies such as XRP also failed to become successful. Since its release in 2012, the value of XRP has often been below one cent. In December 2013, the XRP price reached its then high of around 5 cents. In the bear market, the price initially settled again at under one cent.5 A similar phenomenon was seen with Litecoin, which jumped to over 40 USD and then stabilized at less than 10 USD.6

2014: Development of Ethereum

Before being executed, each transaction is checked by a script to determine under what conditions it is valid. Ethereum was developed on the basis of this core idea. Vitalik Buterin began designing scripts and software for this cryptocurrency as early as 2014. For this purpose, he built up a team of developers. They wrote their own programming languages, which they also used to write Smart Contracts. These flexible contracts allow tokens such as vouchers, images, or real estate shares to be mapped in the blockchain.

Ethereum finally entered the crypto market in August 2015 and became Bitcoin’s competitor just a year later. Its price was 20 USD in the middle of 2016.

2015: Surge for Cryptocurrencies in Crises

Fiat currency crises strengthen the use of cryptocurrencies. This was also the case during the Greek crisis in June 2015, when newly elected Prime Minister Alexis Tsipras promised to end the austerity policies imposed on the country. After some wrangling with the EU Commission over financial aid for the country, Tsipras triggered a referendum on the terms of the bailout. The European Central Bank then cut off loans to Greek banks, forcing them to limit their EUR withdrawals from ATMs to 60 EUR a day.

These capital controls gave Bitcoin momentum and its price rose from 200 to 300 USD after a few months. Greek Bitcoin startups formed and large companies tried to sell their products with Bitcoin.

Despite the euphoria for cryptocurrencies, the end of the Greek crisis approached faster than Bitcoin was able to become established as a means of payment. Interest in Bitcoin also increased during other crises, such as the oil price crisis in Nigeria in 2014 or in Venezuela in 2016.

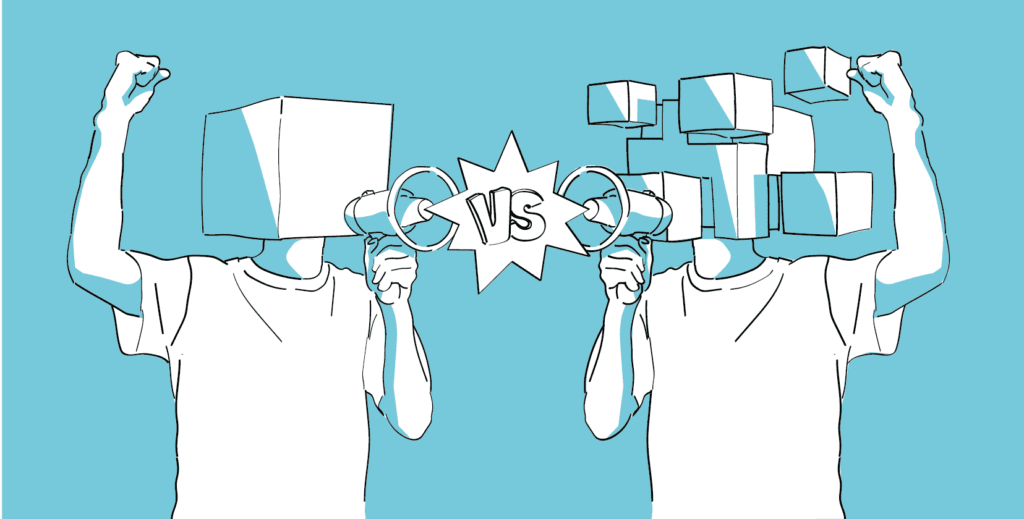

2015: Blocksize Dispute

Gavin Andresens became Satoshi Nakamoto’s successor. The developer made Bitcoin his life’s work, programmed and optimized the source code, and in 2014, he focused on the block size, i.e. the capacity of a Bitcoin block. This is an important size because a full node has to store the whole blockchain and check the information of a transaction as well as forward it to the miners. With more payment transactions, the necessary computing power and storage capacity increases.

Since the blocks in the Bitcoin blockchain were already 0.4 megabytes (MB) in size in December 2014, with a limit of 1 MB, Gavin scaled them up to 20 MB. He had thought through and ruled out technical hurdles such as memory requirements or miners. So in June 2015, he published the Bitcoin Improvement Proposal (BIP101), a proposal to initially increase the block size limit to 8 MB and then double it every 2 years.

However, the block size increase met with resistance from some Bitcoin developers, the so-called small blockers. They were of the opinion that the size of the Bitcoin blocks should remain as low as possible.

The Bitcoin chief developer at that time, Vladimir van der Laan, expressed caution and did not want to change the code until there was a consensus on the block size limit. Since there was no consensus on the size of the blocks, big blocker Mike Hearn made a decision and built BIP101 into his software version for a node “BitcoinXT.”

Hearn saw no way to reach an agreement with the small blockers anymore and turned the decision over to the miners: “We’ll write a modified version of the software and let the miners vote on it, just like they do every time they upgrade.” (Bergmann, C. (2019), p. 331).

On social media, the block size increase was heavily discussed and Mike Hearn received personal attacks. Chinese mining farms and large companies were in favor of the upgrade, so the amount of XT nodes increased. However, after the software update, the amount of data from known DoS attacks overwhelmed the Bitcoin nodes. Many supporters were deterred from using “Bitcoin XT” as a result. In January 2016, Hearn withdrew from Bitcoin development due to the incidents.

2015: The "SegWit" Upgrade

In September and December 2015, Small Blockers held workshops to find a solution for scalability. Pieter Wuille presented a concept called “Segregated Witness and its impact on scalability” during this event. The so-called “SegWit” upgrade increases the capacity of a block by third parties to 1.5 – 2 MB or a maximum of 4 MB, thus improving among other things the performance of transactions. Since “SegWit” is a soft fork, full nodes do not have to participate in the update. Consequently, the bitcoin network’s unity can be preserved without a software upgrade. Gregory Maxwell, CEO of the blockchain company Blockstream, recognized this opportunity and wrote an email to the developers. In it, he compiled all the information and advantages of “SegWit”. In the end, “SegWit” became accepted as a compromise, but was not activated until August 2017.

2016: Big Blocker Resistance

The big blockers around Gavin Andresens were not satisfied with the “SegWit” solution because the soft fork would fail to sufficiently increase capacity and require much more effort than a hard fork. Andresens implemented Bitcoin Classic, which also had a 2 MB limit, and pushed for a hard fork. As soon as 75 percent of miners supported Bitcoin Classic for a week, the fork would be decided.

In February 2016, small blocker Bitcoin developers struck a deal with miners. In the “Hongkong Consensus,” the parties agreed that miners would only use systems compatible with those of the small blockers and that there would be a hard fork based on the “SegWit” update. From then on, Bitcoin Classic was history, given that Andresens had lost the miners’ loyalty. An attempt at another fork with the software version “Bitcoin Unlimited” also failed.

2016: Second Halving

The summer months witnessed upward momentum for bitcoin, with transactions on the rise. An end to the bear market was in sight. On July 9th, 2016, the blockchain reached its 420,000th block. On the day of the second halving, the miners’ reward halved and became 12.5 bitcoin per mined block. Initially, the price settled at 600 USD. In November, halving caused a shortage of generated bitcoin. The bitcoin price rose to 700 USD and then to 1,000 USD by December.

The dream of digital gold continued to spread, and shortly after, the great Bitcoin rally broke out. The disputes over block size, however, were far from over.

Sources:

- Primary Sources: Bergmann, C. (2019). Bitcoin. Die verrückte Geschichte vom Aufstieg eines neuen Geldes. 2. Auflage. Neu-Ulm/Nersingen: MOBY Verlagshütte.

- 1 Böhm, M. (2017). Bitcoin-Meme “HODL”. Wie ein Betrunkener einen klugen Finanztipp gab. Online: https://www.spiegel.de/netzwelt/web/bitcoin-meme-hodl-wie-ein-betrunkener-einen-klugen-finanztipp-gab-a-1184046.html (last access on 20.07.21).

- 2 bitcoinwiki (o. D.). HODL. Online: https://de.bitcoinwiki.org/wiki/HODL (last access on 20.07.21).

- 3 bitcointalk (2013). Bitcoin Forum. Topic: I am Hodling. Online: https://bitcointalk.org/index.php?topic=375643.0 (last access on 20.07.21).

- 4 CoinMarketCap (2021). Bitcoin. Online: https://coinmarketcap.com/de/currencies/bitcoin/ (last access on 20.07.21).

- 5 CoinMarketCap (2021). XRP. Online: https://coinmarketcap.com/de/currencies/xrp/ (last access on 20.07.21)

- 6 CoinMarketCap (2021). Litecoin. Online: https://coinmarketcap.com/currencies/litecoin/ (last access on 20.07.21)

- 7 YouTube/Jon Southurst (2014). Protest at Mt Gox, Tokyo, 14th February 2014. Online: https://youtu.be/ob9Ak1t09Ao (last access on 20.07.21)

Christoph Bergmann

Business journalist and historian Christoph Bergmann is one of Germany's leading crypto experts. He has been fascinated by the world of Bitcoin, Ethereum, etc. since 2013 and has received several awards for his work.