From the Very Beginning to the Birth of Bitcoin

It’s often said that in order to understand the present, one must understand the past; in line with this notion, we would like to share a small series of articles explaining the history of Bitcoin & Co. here on the BISON blog, divided into four parts.

Today, there exist several thousands of cryptocurrencies and the market value of all these coins has recently broken the two-trillion-dollar mark. Central banks are addressing the issue, the general public is discussing its pros and cons, and current price fluctuations have become part of mainstream news. All of this serves as undeniable evidence that cryptocurrencies have become much more significant than their creators had likely ever imagined some 15 years ago. But how did this technological innovation actually come about – who were the people behind this project, what was their motivation, and how did all of this unfold?

Part one of this series covers the early days of cryptography, the first digital currencies, the construction of decentralized networks, and the emergence of Bitcoin.

1976: The "Big Bang" of Cryptographic Methods

The big bang of cryptography – and therefore the basis for the emergence of cryptocurrencies – dates back some 45 years. In 1976, the American National Bureau of Standards and Technology published the Data Encryption Standard (DES) algorithm; it was developed jointly by the IT company IBM and the U.S. federal agency NSA. DES enabled people and companies to communicate via encrypted messages. The U.S. government thus became the first government to publish a cryptographic algorithm.

1990s: Cypherpunks and Digital Currencies

Data that is not encrypted is openly available in the digital world and can be misused, controlled, or even manipulated. In the early 1990s, a movement arose that opposed the potential for “mass surveillance” on the Internet. Known as Cypherpunks, they advocated privacy through embracing cryptography. One of the key drivers for developing widely accessible cryptographic methods at that time was a fundamental distrust of the state’s, and even private institutions’, integrity. Eric Hughes, a central voice among the activists, emphasized the following in a manifesto issued by the Cypherpunks: “We cannot expect governments, corporations, or other large faceless organizations to grant us privacy out of their beneficence. (…) We, the Cypherpunks, are dedicated to building anonymous systems. We are defending our privacy with cryptography (…).” 4 Another idea the Cypherpunks had for achieving more privacy and independence from state institutions was the development of digital, decentralized means of payment.

A forward-thinker who decidedly pushed the idea of digital currencies was cryptographer David Chaum. He founded DigiCash in the late 1980s and, through this company, developed the very first digital currency: eCash launched on May 26th, 1994. However, despite conducting trials with Microsoft, Visa, Deutsche Bank, and Mastercard, DigiCash went bankrupt in 1998. The company seems to have failed because of its inability to demonstrate leadership as a pioneer and due to the restrained acceptance of digital cash in the retail sector. Other projects by other ingenious minds also failed, such as e-gold, Digital Monetary Trust, and Wei Dai’s Bitcoin-like b-money. Regardless, each of them still followed the principle of a central entity through which transactions were processed. This approach proved to be a dead-end and was replaced by the principle of decentralization.

Turn of the Millennium: Decentralized Structures

In 1999, Napster offered MP3 music files free of charge on its platform, revolutionizing the music industry which had previously been dominated by physical sound carriers. Initially, this no-cost service was blocked by government agencies due to associated copyright infringements. However, decentralized structures of file-sharing platforms formed to defend themselves against those restrictions, which were perceived as excessive encroachments on personal freedom. Decentralized file sharing means that files are not made available for download on a central computer or server that can easily be shut down. Instead, numerous computers are connected to form a so-called peer-to-peer (P2P) network. Here, each computer in the network serves as both a storing and downloading computer.

- Advantage #1: Not every “node” has to hold all the data available on the network, but all of it is available to the user of the network.

- Advantage #2: If a node is cut off from the network, file sharing still works.

All efforts made by government agencies to put a stop to the continued illegal exchange of music files quickly turned into a neverending battle – if a few nodes in the global network were shut down, new ones simply appeared elsewhere. This demonstrated just how powerful decentralized networks could be.

2008: Satoshi Nakamoto and Bitcoin

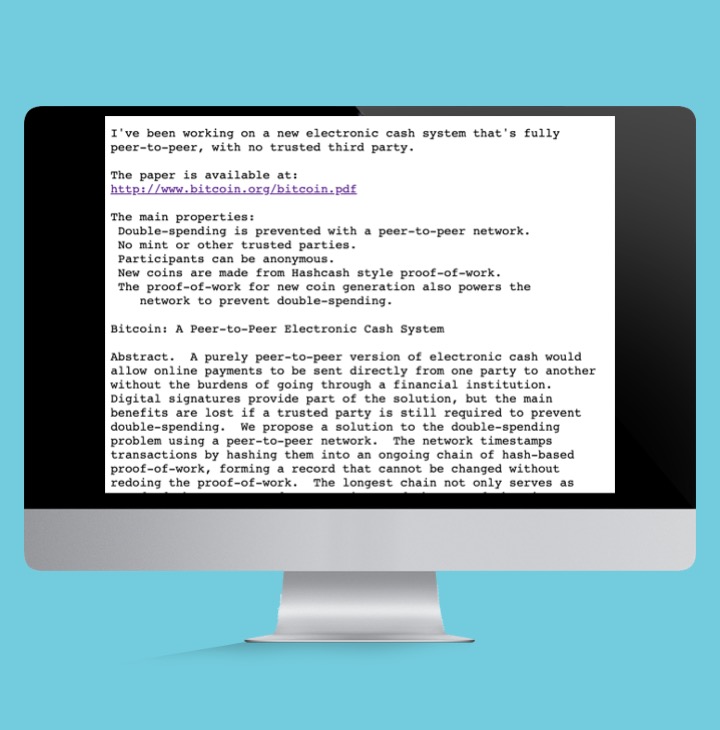

Bitcoin’s story is closely linked to a figure referred to as Satoshi Nakamoto; although, to this day, no one knows for sure who he is or how many people he represents. Satoshi Nakamoto adapted the fundamental idea of Wei Dai’s b-money and, in doing so, recognized the advantages of P2P networks and developed his own attack-proof system for a digital currency using cryptographic methods. He dubbed his digital currency Bitcoin, and on August 18th, 2008, registered the domain bitcoin.org.

On November 1st, 2008, Nakamoto sent a message to the Cypherpunks’ e-mail list containing a white paper that outlined the basic ideas of a secure, decentralized digital currency. At first, the concept only managed to convince a few of the movement’s supporters. Among those interested were Ray Dillinger and Hal Finney, both of whom would go on to play a leading role in the subsequent craze for cryptocurrencies.

Dillinger had been involved in digital cash since the 1990s. In November 2008, he examined excerpts of Bitcoin’s source code, but doubted the cryptocurrency’s potential for success.

2009: Bitcoin Is Born

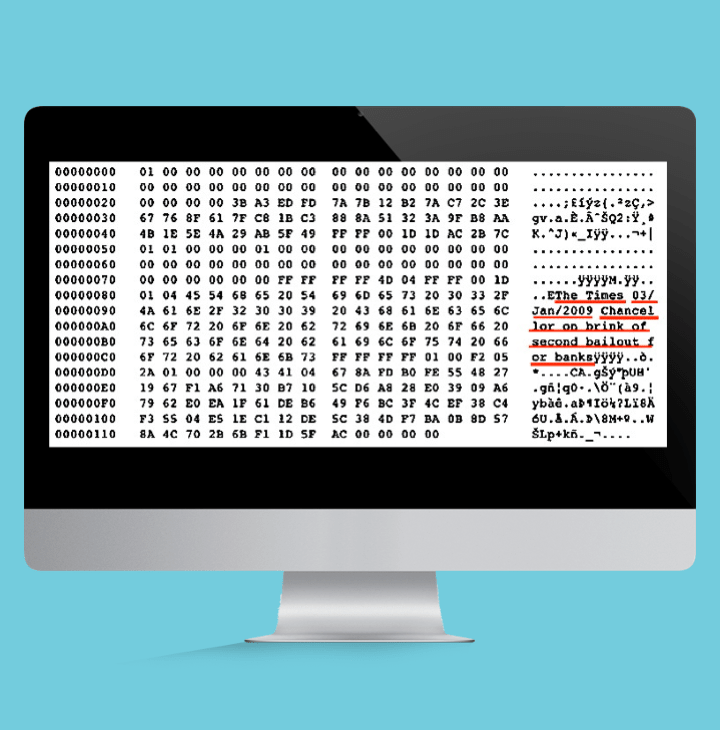

anuary 3rd, 2009 – this is the day Bitcoin was first mined by its inventor Satoshi Nakamoto. The first 50 Bitcoin were created using what’s known as the Genesis Block and its code contains a legendary reference to a Times article on the banking crisis: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

About a week later, on January 9th, Nakamoto published version “Bitcoin 0.1” of Bitcoin’s software as an open-source license. In other words, he allowed anyone to see, download, and use the Bitcoin code.

Nakamoto himself set a cap of 21 million Bitcoin to ever be created and continued to be involved in cryptocurrency until 2010. From that point on, he has not been heard from publicly.

On January 12th, the first-ever transaction took place on the blockchain. In block 170, 50 BTC were sent to the wallet 1PSSGeFHDnKNxiEyF[…]. This is believed to be owned by developer Hal Finney. 1 US dollar was equivalent to 1,309.03 Bitcoin in October 2009.1

And with that, digital money based on a decentralized blockchain, along with the use of encryption methods that had been well known for decades, finally came into being. Still, no one could have imagined the extent to which Bitcoin would grow over the course of time..

Source:

- Main Source: Bergmann, C. (2019). Bitcoin. Die verrückte Geschichte vom Aufstieg eines neuen Geldes. 2. Auflage. Neu-Ulm/Nersingen: MOBY Verlagshütte.

- 1 Kroker, M. (2019). Die Geschichte von Bitcoin vom Start im Oktober 2008 bis zu den Kursturbolenzen Ende 2019. Online unter: https://blog.wiwo.de/look-at-it/2019/12/19/die-geschichte-von-bitcoin-vom-start-im-oktober-2008-bis-zu-den-kursturbulenzen-ende-2019/ (last access on June 23th, 2021).

- 2 metzdowd (o. D.). Bitcoin P2P e-cash paper. Online: https://www.metzdowd.com/pipermail/cryptography/2008-October/014810.html (last access on June 23th, 2021).

- 3 Scheider, D. (2020). 5 versteckte Nachrichten auf der Bitcoin Blockchain. Online: https://www.btc-echo.de/news/5-versteckte-nachrichten-auf-der-bitcoin-blockchain-92081/ (last access on June 23th, 2021).

- 4 Hughes, E.(o. D.). A Cypherpunk’s Manifesto. Online: https://nakamotoinstitute.org/static/docs/cypherpunk-manifesto.txt (last access on June 23th, 2021).

Christoph Bergmann

Business journalist and historian Christoph Bergmann is one of Germany's leading crypto experts. He has been fascinated by the world of Bitcoin, Ethereum, etc. since 2013 and has received several awards for his work to date.