You’re likely familiar with this scenario: You want to invest in a cryptocurrency like Bitcoin – which fluctuates heavily on the crypto market – and would like to do it as cheaply as possible. You keep an eye on the market until, finally, Bitcoin falls below a certain price. You want to buy, but something stops you. Perhaps you have no signal, your battery’s dead, or it’s the middle of the night and you’re deep asleep. Regardless, one thing’s clear: you’ve missed your chance. To prevent this from happening to you in the future, BISON is launching a function comparable to a “Limit Order”.

In this blog post, we will show you what a limit order is, how it works, the advantages of using it, and how to set it up correctly in your BISON app.

What Does Limit Order mean?

Among stock traders, the word “order” is the general technical term for a trading instruction. There are different forms, such as the market order or the limit order.

With a market order, the instruction to sell or buy stocks or cryptocurrencies is immediately executed – at a price that is paid on the market at that moment. It is all about timing.

With a limit order, on the other hand, the point in time is not important; it is only the price that matters. The desired transaction is executed only when the predefined price limit is reached. The limit order can therefore be executed within a few days or within a few weeks. It depends on whether the price has moved in the direction that the buyer/seller has set for the execution of his/her order.

How Does a Limit Order Work?

Limit orders are divided into entry orders (buy) and exit orders (sell).

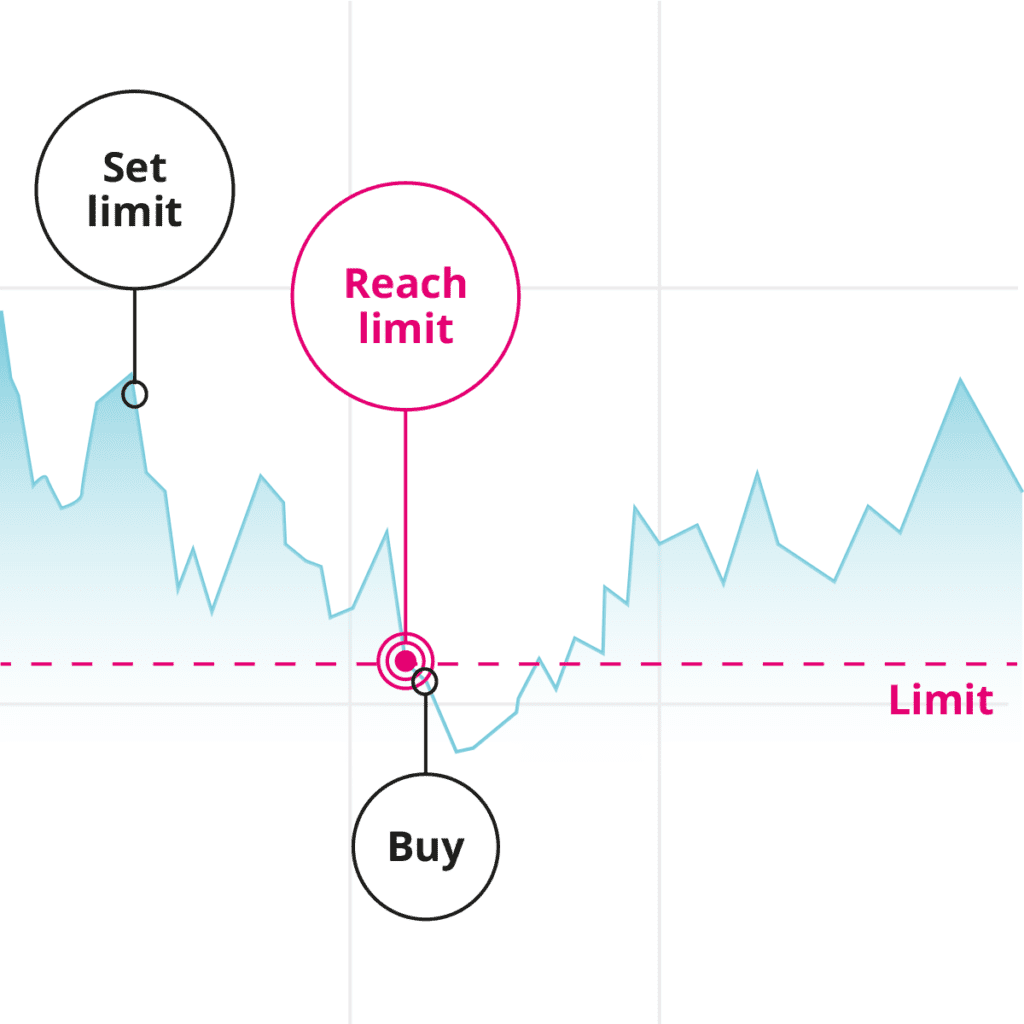

With an entry order, you set the price limit at which you want to invest in new cryptocurrencies and specify the number of Bitcoin, Ethereum, and so on to be invested in. If the market price is above your set limit, your order to buy will not be executed. As soon as the price falls below your price limit, your order to buy will be executed.

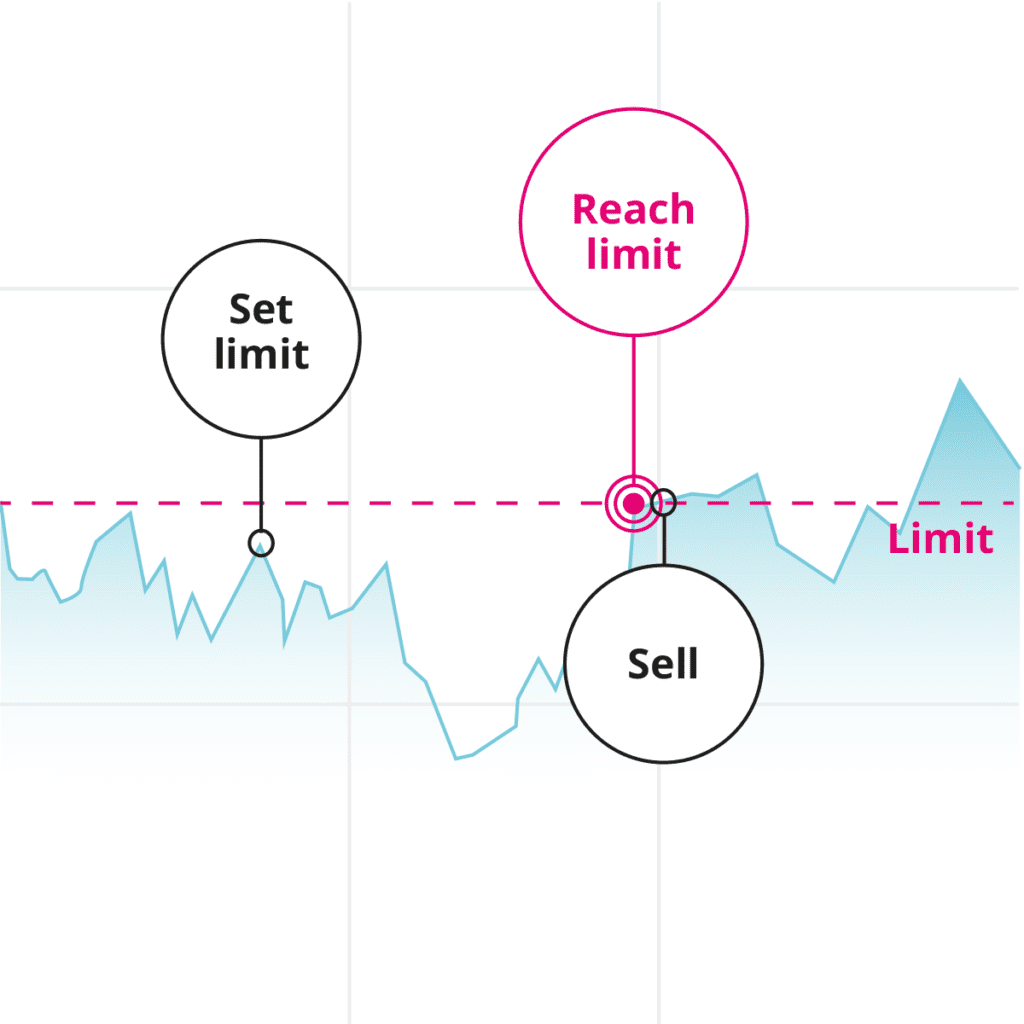

With an exit order, you determine the minimum limit at which you want to sell your cryptocurrencies. You therefore specify the limit and the quantity here as well. If the price is currently below your price limit, you will not sell until it exceeds the set price.

When Is a Limit Order Executed?

In principle, a limit order is executed as soon as the price you have set is reached. Your order is valid until you delete the order or change its price limit.

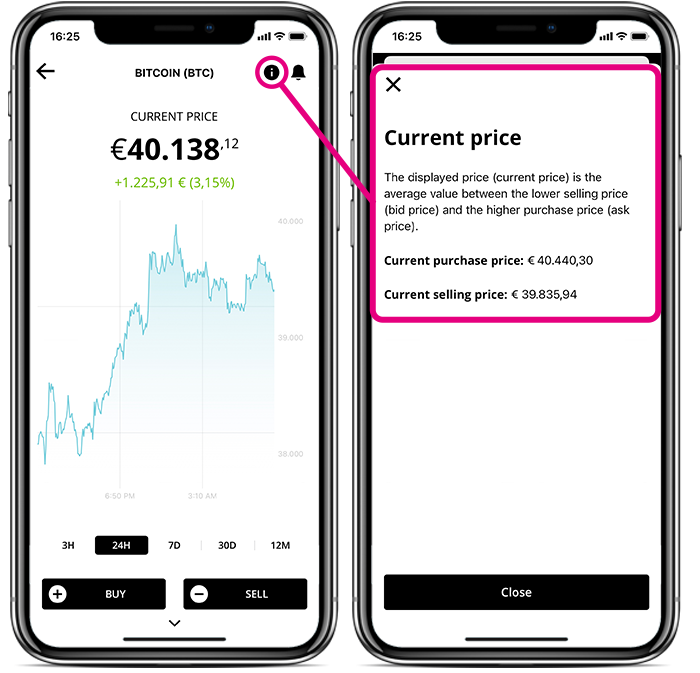

Please note: The current price in the market overview shows you the average of the buying and selling price. The individual values can be displayed in the price history via the info symbol. An exit order is therefore only executed as soon as the current selling price is equal to or higher than the defined price limit. The entry order is triggered when the purchase price is lower or equal.

However, the validity of an order at BISON is initially limited to 90 days. This means that after this period, you will have to set your limit again. But don’t worry, we will notify you once your limit order has expired.

What Are the Advantages and Disadvantages of a Limit Order?

Advantages

- Advantage #1: With a limit order, there is no need to continuously track prices on the crypto market. You can easily set the price you prefer and your order will be triggered automatically as soon as market conditions match.

- Advantage #2: A limit order minimizes the risk of price jumps because transactions are executed only within the specified limit.

- Advantage #3: Limit orders make it easier for you to sell/buy and thus target your trading strategy. So if you think that cryptocurrencies will never exceed a certain level, you can sell at whatever price you anticipate.

Disadvantages

- Disadvantage #1: The crypto price may never reach your defined limit.

- Disadvantage #2: Limit orders are only valid for a certain period of time.

Limit Order – Example

You want to invest in Bitcoin at a low price, but the current price is 40,000 EUR. You want to buy at 35,000 EUR, so you create a limit order. You define your price limit and the number of Bitcoin you want to buy. As soon as the market price drops to 35,000 EUR or lower, your order is automatically executed and you buy Bitcoin at its current market price. You can display this in the price history via the info symbol.

You want to sell them again when their market price has doubled. To do this, you create a limit order that automatically activates the sale of your cryptocurrencies starting at 70,000 EUR. By selling them, you’ve made a profit.

What Is the Difference between a Market Order, Limit Order, Stop Order, And Stop-Limit Order?

Limit Order: Ensures that transactions, such as the purchase or sale of cryptocurrencies, are executed when a predetermined price value is reached.

Stop Order: Stop orders are divided into stop-buy orders and stop-loss orders. For example, if you want to secure a profit from cryptocurrencies when prices are falling, you can set a stop. As soon as this stop (limit) is reached, the cryptocurrencies are sold at the next possible price (stop-loss order).

Stop-Limit Order: Combines the above functions. First, a stop price and a limit price are set. When the stop limit is reached, the limit order is activated.

Market Order: The order for buying/selling cryptocurrencies is executed immediately based on the price valid at that moment.

BISON has introduced the limit order of the mentioned order types.

How Do You Set a Limit Order in the Bison App?

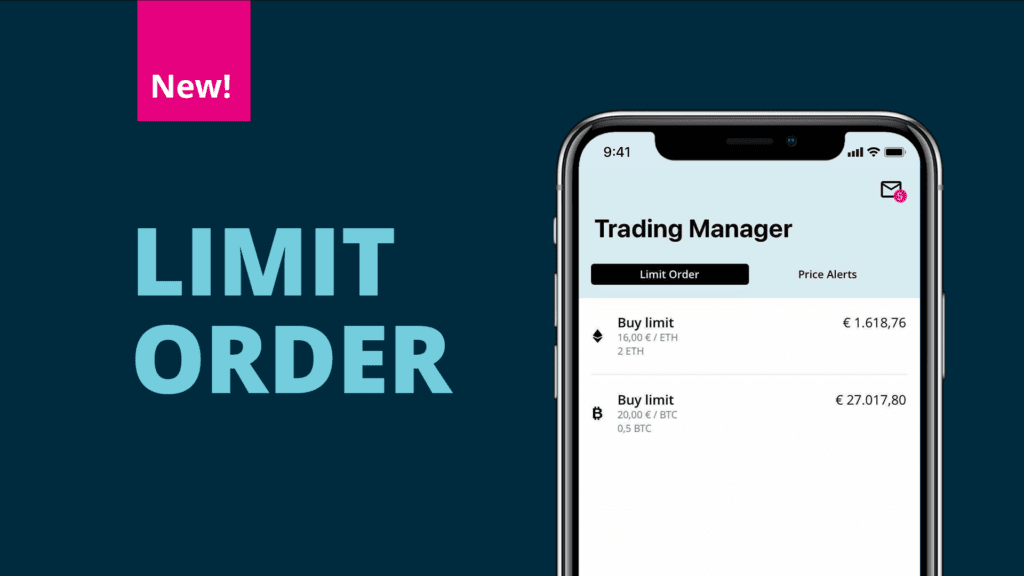

1. Open Trading Manager

To set a limit order in your BISON app, first go to the “Trading Manager” in the bottom navigation bar. Here you can select whether you want to activate a limit order or a price alert.

2. Specify cryptocurrency

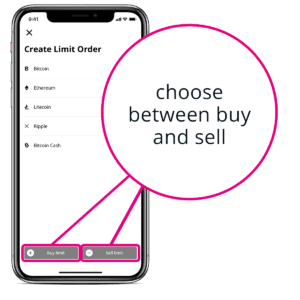

When creating a new limit order, you first specify the cryptocurrency for which you want to set a price limit.

3. Select buy or sell

Decide whether you want to create your limit order to buy or sell cryptocurrencies.

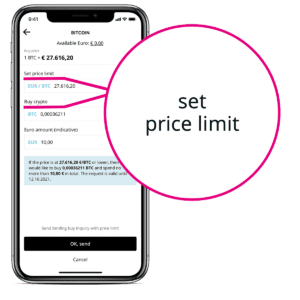

4. Set price limit

Then set your limits.

BISON will notify you as soon as your order is executed. After 90 days your price limit will expire and you will have to set it again.