As of now, two new cryptocurrencies can be bought and sold in the BISON app: Chainlink (LINK) and Uniswap (UNI). They are among the top 15 cryptocurrencies worldwide. LINK and UNI add to the BISON app’s current portfolio of five tradable coins:Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP (XRP) und Bitcoin Cash (BHC).

In this blog post, we’ll introduce you to the UNI token, as well as the Uniswap platform behind it, in more detail.

Who’s behind Uniswap?

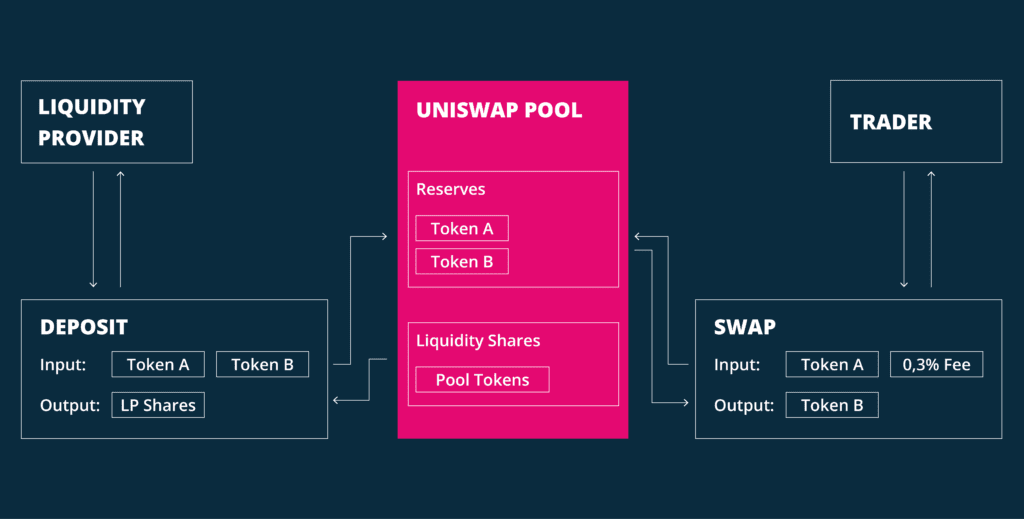

Transactions via Uniswap work without any intermediaries and thus accelerate the trading of cryptocurrencies. For this purpose, different liquidity pools exist, which are defined via smart contracts. In addition, an algorithm automatically determines the exchange rate between the currencies depending on the liquidity dynamics. This means that there is no need to use order books to determine the price based on supply and demand, as is necessary with other platforms.

What Is UNI?

1 billion UNI has been generated and is set to be distributed within four years. There was a lot of hype around the launch of this crypto token – its trading volume of $386 billion and a total of over 61 million transactions also speak for themselves. UNI’s current all-time high is just over 38 EUR, which was reached in May 2021.

What Are Liquidity Pools?

Conclusion

The Uniswap platform is one of the most noteworthy projects in the entire crypto universe. Trading in cryptocurrencies is decentralized, automated, and thus more efficient than on central exchanges. Shortly after its launch, the UNI token got off to a strong start and, after about a year, has managed to stand its ground alongside other major coins on the crypto market. That’s why we’re thrilled to announce that, as of now, you can buy and sell UNI in the BISON app – the Uniswap unicorn’s favorite token.