From the birth of bitcoin to the emergence of altcoin

Bitcoin is on the rise. Today, there exist several thousands of cryptocurrencies and the market value of all these coins has recently broken the two-trillion-dollar mark. Central banks are addressing the issue, the general public is discussing its pros and cons, and current price fluctuations have become part of mainstream news. All of this serves as undeniable evidence that cryptocurrencies have become much more significant than their creators had likely ever imagined some 15 years ago. But how did this technological innovation actually come about – who were the people behind this project, what was their motivation, and how did all of this unfold? In line with the notion that, in order to understand the present, one must understand the past, we’d like to share the story of Bitcoin & Co in a small series of articles here on the BISON blog. In the first part we dealt with the early days of cryptocurrencies through to the birth of Bitcoin. The second part is about the first transactions and crypto exchanges, the first bubble, and the emergence of Altcoin.

2009: First Bitcoin Exchanges

On January 3rd, 2009, Satoshi Nakamoto released the open-source software “Bitcoin 0.1”. The first transaction took place nine days later on the Bitcoin blockchain, marking the beginning of a decentralized means of payment.

An important early supporter of the Bitcoin movement was Finnish student Martti Malmi. A rather reserved IT nerd, he had been writing software code since he was twelve and even helped Nakamoto mine Bitcoin. Later, the two became partners and Malmi further developed the bitcoin.org website and code.

For a total of 5 EUR, the Finn sold 5,050 BTC at the time – a pretty bad deal from today’s perspective given that 5,050 BTC would be worth around 151,500,000 EUR (as of June 7th, 2021, the price per Bitcoin was listed at roughly 30,000 EUR). According to his Twitter account, he now regrets making the rather unfavorable trade.1 In 2010, Malmi founded the first Bitcoin exchange – bitcoinexchange.com – and here, bitcoin could be traded in exchange for EUR.

I’d be a *billionaire* now if I hadn’t sold the 55,000 bitcoins I mined on my laptop in 2009-2010 way too early (mostly before 2012). That is regretful, but then again, with the early bitcoiners we set in motion something greater than personal gain.

— Martti Malmi (@marttimalmi) December 18, 2020

2010: Start of Transactions

The first German Bitcoiner was SmokeTooMuch. This student was passionate about decentralized networks and wanted (through decentralized networks) more protection from government surveillance. In 2010, he tried to sell 10,000 BTC for 50 USD. His attempt, however, was unsuccessful because he was unable to find any buyers for his Bitcoin.

But the crypto scene grew, and gradually a network of interested people, developers, and miners emerged. With the first hardware wallet, Trezor, bitcoiners now had the ability to store cryptocurrencies securely offline.

On May 22nd, American Lazlo Hanyecz bought two pizzas for the price of 10,000 BTC. His order is considered the first Bitcoin transaction, and May 22nd has since been referred to as “Bitcoin Pizza Day” among Bitcoin enthusiasts.

By July 7th, the bitcoin price had already increased tenfold: for one dollar, you could receive 0.08 BTC.2 In November, the bitcoin price was already at 0.5 USD per BTC.3 In addition, today’s Bitcoin logo was created in the same month: a white B with two lines running through it, against a golden or orange background.4 About half a year after the first bitcoin payment, the first mobile transaction took place on December.3

2010: Life Without Satoshi Nakamoto

Four days later, on December 12th, Satoshi Nakamoto posted on the Bitcoin forum for the very last time before disappearing. His absence led to wild speculation: Did he get cold feet? Is he still alive? Is he just waiting for the right moment to sell all his Bitcoin and get rich in one fell swoop?

American retiree Dorian Prentice Satoshi Nakamoto was once mistaken for the Bitcoin founder, and Australian Craig Steven Wright actually went as far as to impersonate Nakamoto. The fact is that, to this day, it has been impossible to identify the inventor of Bitcoin. Every attempt to track him down has failed.

2011: Bitcoin Exchanges and Bubbles

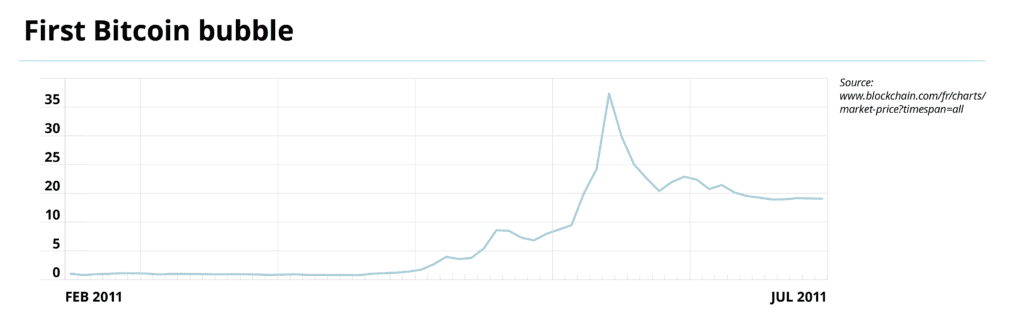

Until 2011, the demand for cryptocurrencies as a means of payment had been rather low. Although a quarter of the maximum possible number of Bitcoin had already been mined on January 28th, 2011, 5 the price reached the value of 1 dollar for the first time about two weeks later.

Frenchman Mark Karpelès learned about Bitcoin in late 2010 and was immediately intrigued. Within ten days, he translated sections of Bitcoin code into the scripting language PHP, opened a Bitcoin wiki, compiled the IP address of the network in a database, constructed his own wallet, and recognized BTC as payment for his own business – a feat he accomplished in a very short time. Karpelès took over the crypto exchange Mt. Gox on March 6th, where it finally became possible to trade in real-time. At that time, you received 1 BTC for 5 cents. The platform went online the previous year and later became one of the largest trading venues for bitcoin.

In May, the bitcoin price rose to 3 EUR and in June, the price increased tenfold to 30 EUR – and Mt. Gox’s trading volume was 3 million USD per day. In percentage terms, this was the strongest price increase in history thus far. However, a short time later, the bubble burst and the price plummeted.

Shortly after, Mt. Gox became the scene of the worst crash in Bitcoin history. Due to password issues, hundreds of accounts were hacked and their bitcoin holdings sold. The hacker subsequently bought the Bitcoin again for less money and wanted to cash them out in dollars. Within a short period of time, the price dropped from 17.50 USD to 0.01 USD. The crypto trading venues collapsed and shut down as quickly as possible. As a result, Karpelès was able to prevent further payouts and a Bitcoin heist. The platforms went back online after a few days and the bitcoin price was at the same level as before the attack.

Due to the low prices, more companies and individuals invested in Bitcoin, more software was developed, and the Bitcoin scene grew. In the summer, Oliver Flaskämper developed the German trading site bitcoin.de, which went online a short time later in September. On this platform, 60% of trading activities with Bitcoin took place in 2013.

2011: Bitcoin Jesus und the King of Mining

American Roger Ver was obsessed with Bitcoin and found his calling in Bitcoin lectures. He traveled the world and wanted to inform everyone about Bitcoin in countless speeches: “It’s an incredibly powerful tool that will liberate not only Americans, but all countries on this planet. It’s the best kind of money the world has ever seen. Nothing has gotten me more excited than the incredibly diverse ways Bitcoin can make the world a better place.” (Bergmann, C., p. 129) Ver spread this Bitcoin message with such passion that he became known as “Bitcoin Jesus.”

Bitcoin also became a way of life for Jihan Wu from China. In May 2011, he invested in the cryptocurrency for the first time, produced a Chinese translation of the Bitcoin whitepaper, and built the 8btc.com platform, including a forum and online magazine. Two years later, together with Miere Zhan, he founded Bitmain, which became the largest mining company in the world.

2011: The Dark Side Of Bitcoin

“The idea was to create a website where you could buy anything anonymously, without leaving a trace.” This was what American student, Ross Ulbricht, had in mind in 2011 when he created Silk Road – a fast-growing online platform comparable to Amazon. Through payment with Bitcoin, the use of the Tor network, an untraceable encryption technology, and a rating system, an international trans-shipment center for drugs came to exist. Other criminal activities were also financed with Bitcoin on the Darknet.

For a long time, governments were powerless against this because, in the darknet, necessary information for the prosecution of crimes, such as an IP address, cannot be traced. Ross Ulbricht became one of the most wanted men in the US and was known as “Dread Pirate Roberts”. In 2013, the FBI finally managed to find the Thor server and, indirectly, Ulbricht. Immediately after the arrest, about 144,000 Bitcoin were seized and later auctioned. Silk Road was shut down.

However, this shutdown was not enough to permanently put an end to the darknet. These criminal activities contributed, among other things, to the fact that government agencies regulate Bitcoin, prohibit trading, or define rules for trading venues such as the KYC process. Law enforcement agencies also now have access to the usage data of crypto exchanges in the event of suspicion.

2012: Bitcoin as a Means of Payment

In May, Ethereum creators Vitalik Buterin and Mihai Alisie published the first issue of Bitcoin Magazine. The print edition and online magazine are among the oldest and most established sources of bitcoin news and analysis.

In 2012, the Satoshi Dice gambling game accounted for about 50 percent of Bitcoin transaction volume. The principle was simple, similar to roulette: a bet is placed on a square in roulette, but in Satoshi Dice it is sent to a Bitcoin address. The probability and amount of winning are stored at this address.

On November 15th, WordPress accepted BTC as a means of payment. On November 28th, the first 210,000 Bitcoin blocks had been mined, meaning the first halving took place, as planned. From then on, miners only earned 25 BTC instead of 50 BTC per block.

2013: The First Altcoin and Bitcoin Recognition

As early as 2011, the first attempts were made to integrate altcoins, such as Namecoin, into the crypto scene. However, most altcoins were not developed and listed on marketplaces until 2013. For example, Litecoin emerged in April, and Ripple in August.

The crypto scene developed more altcoins and thus strengthened the role of Bitcoin; investments in altcoins were paid for with Bitcoin.

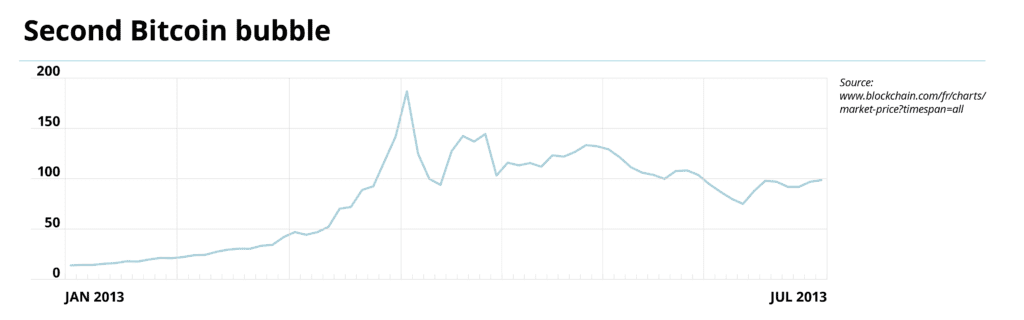

At the beginning of the year, the price of Bitcoin was around 15 USD. On April 10th, Bitcoin reached its then-peak of 266 USD. The subsequent price decline was just as erratic as the price increase. Once again, there was a hacker attack on Mt. Gox. The server was overloaded and the trading platform shut down for the second time. However, the price then stabilized at a level of around 100 USD.

Four months later, on August 22nd, the German Ministry of Finance allowed the use of Bitcoin and recognized it as a private currency, although this was later adjusted in a 2018 court ruling. According to that ruling, Bitcoin is a unit of value that “is accepted by natural or legal persons on the basis of an agreement or actual practice as a means of exchange or payment or serves investment purposes and can be transferred, stored, and traded electronically.” [§1.11.10 German Banking Act].6

Since the end of 2013, it has been possible to pay with cryptocurrencies on certain online portals in Germany. The problem, however, is that people would rather own Bitcoin than spend it; no one wants to use it as a means of payment. So cryptocurrencies still have to wait for their big breakthrough.

Bitcoin and cryptocurrency trading had come a long way by the end of 2013. By the end of November, the value was already at 1000 USD per BTC. But the story isn’t over – there’s still much more to share about this journey. You will find out in the next blog post.

Sources:

- Primary sources: Bergmann, C. (2019). Bitcoin. Die verrückte Geschichte vom Aufstieg eines neuen Geldes. 2. Auflage. Neu-Ulm/Nersingen: MOBY Verlagshütte.

- 1 Malmi, M. (2020). Tweet. Online: https://twitter.com/marttimalmi/status/1339908783187832834 (last access on 25.06.21).

- 2 Ivanov, A./Imöhl, S. (2021). Bitcoin fällt unter 30.000 Dollar. Online: https://www.handelsblatt.com/finanzen/maerkte/devisen-rohstoffe/bitcoin-kurs-aktuell-bitcoin-faellt-unter-30-000-dollar/26896026.html (last access on 25.06.21).

- 3 Kroker, M. (2019). Die Geschichte von Bitcoin vom Start im Oktober 2008 bis zu den Kursturbolenzen Ende 2019. Online: https://blog.wiwo.de/look-at-it/2019/12/19/die-geschichte-von-bitcoin-vom-start-im-oktober-2008-bis-zu-den-kursturbulenzen-ende-2019/ (last access on 25.06.21).

- 4 Lange, G. (2020). Bitcoin und die Geschichte des Logos für BTC. Online: https://www.blockchain.com/btc/block/105000 (last access on 25.06.21).

- 5 Blockchain (o. D.). Block 105000. Online: https://www.blockchain.com/btc/block/105000 (last access on 25.06.21)

- 6 Wikipedia (o. D.). Bitcoin. Online: https://de.wikipedia.org/wiki/Bitcoin (last access on 25.06.21)

Christoph Bergmann

Business journalist and historian Christoph Bergmann is one of Germany's leading crypto experts. He has been fascinated by the world of Bitcoin, Ethereum, etc. since 2013 and has received several awards for his work.