Summary

- The crypto market is highly volatile. This is particularly true for smaller coins with low market capitalization, where high volatility and low liquidity from low trading volume are especially risky.

- Psychological factors such as FOMO, panic selling, or overtrading also represent significant risks for crypto traders.

- Staking carries risks as well: not only limited availability but also the danger of slashing.

- Strategies such as diversification, stop-loss orders, and thorough coin analysis can help reduce these crypto risks.

- Regulated and secure trading platforms like BISON can also help limit security-related risks.

What risks exist in crypto trading?

The biggest risk in crypto trading is high volatility. This may apply less to Bitcoin and large altcoins like Ethereum or Solana, and more to smaller cryptocurrencies with low market capitalization. Low liquidity can also cause sharp price swings, making large fluctuations a daily occurrence. Quick losses (and gains) are therefore common in crypto trading.

The six biggest risks for crypto traders and investors:

- High volatility: Crypto prices can rise or fall sharply within short periods. Annualized volatility averages around 54%, compared to 10.5% for stocks. This makes forecasting difficult and increases the risk of loss, especially with short-term trading.

- Low liquidity: For coins with low trading volumes (e.g., only €200,000 in 24h), it can be difficult to buy or sell larger amounts without moving the price significantly. This increases the risk of slippage—the difference between the expected and actual trade price.

- Lack of security: Wallet access, seed phrases, private keys—traders manage a lot of sensitive data. If not properly protected, these can become major security risks, whether through the broker or for you personally. Phishing attacks and platform hacks are also risks. BISON customers can find 10 tips here on how to protect their crypto account.

- Unregulated providers: Platforms that are not regulated or supervised often lack adequate security measures. In the worst case, they can disappear overnight, taking your investments with them. BISON, for example, complies with the Transfer of Funds Regulation and is supervised accordingly.

- Whale influence: Large investors (“whales,” often defined as holding 1,000 BTC or more) can move markets significantly with just a few transactions. This makes crypto prices vulnerable to manipulation or sudden swings.

- Technical risks: Faulty smart contracts, network issues, or bugs in wallets (or entire exchanges) can lead to unexpected losses.

The Markets in Crypto-Assets Regulation—better known as MiCA or MiCAR—was created to protect consumers from risks in crypto trading. BISON is regulated under MiCAR and complies with EU standards for crypto service providers. MiCAR has been in force since early 2025 and sets requirements for providers across the EU.

Psychological risks in crypto trading

Alongside “hard” risks, there are also psychological ones. These include dynamics like FOMO and overtrading.

| Risk | Description |

|---|---|

| FOMO (Fear of Missing Out) | Fear of missing out on strong price movements often leads to impulsive buying during hype phases |

| Panic selling | Sharp price drops create stress and “shaky hands,” often resulting in premature selling to avoid further losses |

| Overtrading | Frequent, impulsive trading without a clear strategy—this eats up fees and rarely outperforms simply holding (HODL) |

| Confirmation bias | Only information that confirms one’s own existing views is noticed, while risks are ignored |

When staking, validators can be penalized for violating network rules. This is known as “slashing” and means that part of the staked coins may be permanently deleted or withheld. If you provide your coins for staking, you can also be penalized, even if you did not personally make a mistake.

Please note that this service is currently not regulated under MiCAR and lacks the protections and oversight established by EU regulations. For comprehensive information on staking risks, please refer to the Special Terms and Conditions for Staking.

5 Risk Management Strategies for Investors and Traders in the Crypto Market

To reduce risks, traders can apply various strategies. The key is diversification: don’t put everything into one coin, and research thoroughly before buying. Active traders can use stop-loss and take-profit orders, while long-term investors benefit from cost averaging with a savings plan.

1. Diversification – more security

It’s recommended to spread your crypto budget across multiple coins rather than putting it all into one. Diversification reduces the risk of being hit hard if a single coin’s price falls sharply.

2. Stop-loss and take-profit orders

With certain order types when trading Bitcoin & other cryptocurrencies, you can better protect yourself against sharp price losses while also securing gains. At BISON, you have two options for this:

- Stop-loss orders: Trigger an automatic sale if the price falls below a set level, limiting losses.

- Take-profit orders: Secure gains by selling automatically when a target price is reached.

3. Analyze coins before buying

Check whether a coin is reputable, useful, and relevant long-term. Pay attention to the whitepaper, development team, tokenomics, and real-world use cases. Buying blindly increases the risk of falling for hype projects or scams—such as the infamous OneCoin case.

4. Use risk management tools

Many platforms offer tools such as price alerts (also available at BISON), portfolio overviews, or risk ratings. Specialized providers like Messari or Coin Dance also provide detailed crypto analysis.

5. Use a savings plan

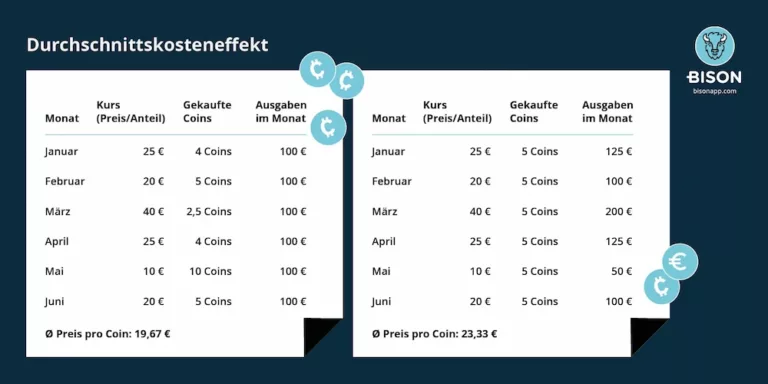

With a savings plan, you invest regularly—and at BISON, automatically at intervals you choose—into cryptocurrencies. This spreads your risk over time, and you benefit from the so-called cost-average effect, also known as the average cost effect

Here’s a concrete example for better understanding: Suppose you invest €100 in Solana each month with a savings plan.

- In month 1, the price is €150, and you receive 0.67 SOL.

- In month 2, the price falls to €75, and you receive 1.33 SOL.

- In month 3, the price rises to €100, and you receive 1 SOL.

After three months, you have invested €300 and purchased a total of 3 coins. Your average price is €100 per SOL—even though the price was as high as €150 in between.