Since January 1, 2026, the EU directive DAC8 has been in force, changing the tax treatment of cryptocurrencies. In Germany, DAC8 has been transposed into national law through the Crypto-Asset Tax Transparency Act (Kryptowerte-Steuertransparenz-Gesetz, KStTG).

Under the new directive, tax-relevant data on crypto transactions has been exchanged directly between authorities within the European Union since the start of this year. The aim is to ensure that income is accurately recorded and correctly classified for tax purposes. DAC8 therefore represents a key step toward greater legal certainty and trust.

- The objective of DAC8 is to further improve tax transparency within the EU, enabling tax authorities to better track income generated from cryptocurrencies.

- Under DAC8, providers of regulated crypto trading platforms such as BISON are required to report user data to tax authorities as part of their statutory reporting obligations. As a user, you are not directly subject to reporting requirements yourself. User data is reported automatically to the relevant authorities within the EU.

- To ensure accurate reporting by BISON, existing BISON users must keep their personal details up to date in their account and provide all tax identification numbers (tax IDs) in their user account by December 31, 2026 at the latest. Trading cryptocurrencies remains fully available to BISON users without restriction until that date.

- New BISON users may only start trading after completing the onboarding process and providing their tax IDs in their account. If new customers do not provide their tax IDs, they cannot trade.

What does DAC8 mean for crypto investors?

DAC8 is an EU directive. Even before its introduction, EU tax authorities exchanged standardized data on bank accounts and financial assets under the Automatic Exchange of Information (AEOI). Since January 1, 2026, transactions involving cryptocurrencies have also been included. Previously, such transactions were sometimes difficult for tax authorities to track.

As a result, service providers such as BISON are now required to collect, verify, and report certain data relating to crypto investors and their transactions to the relevant authorities. From an investor’s perspective, it is important to note that DAC8 does not introduce higher taxation per se but rather increases transparency and legal clarity.

When does DAC8 apply in Germany?

DAC8 entered into force across the European Union on January 1, 2026. The directive does not apply retroactively. The new reporting obligations generally apply only to transactions carried out from January 1, 2026 onward. The first report will be submitted in 2027 for the 2026 tax year. DAC8 does not impose any additional tax burden on investors.

Please note: Tax authorities may still request older data. Earlier crypto transactions may therefore remain tax-relevant and may need to be reported retrospectively if required. You can find a complete overview of all your transactions on BISON in the Info Report, which is available at any time under Account → Reports → Crypto Info Report.

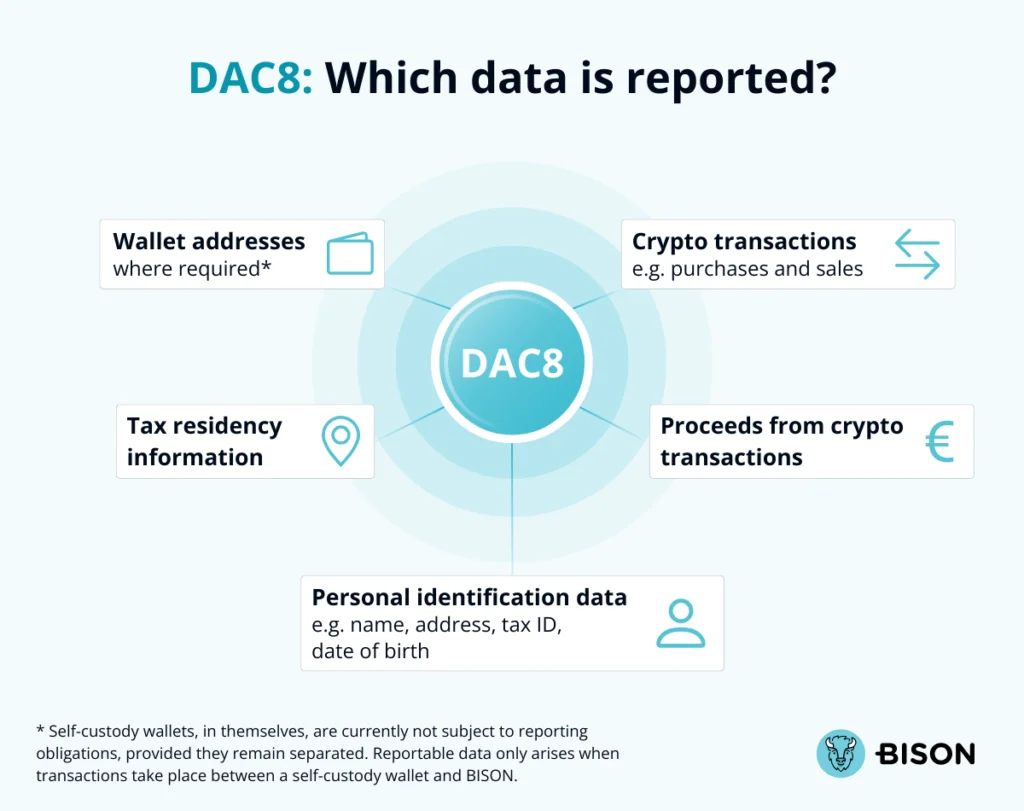

Which data is reported under DAC8?

The reporting required under DAC8 is handled by BISON on your behalf. The following data is reported:

- Personal identification data (g. name, address, tax IDs, date of birth)

- Tax residency information

- Crypto transactions (g. purchases and sales)

- Proceeds generated from crypto transactions

- Wallet addresses, where required: Self-custody wallets, in themselves, are currently not subject to reporting obligations, provided they remain separated. Reportable data only arises when transactions take place between a self-custody wallet and BISON.

BISON does not transmit any data beyond what is legally required.

What do I need to do under DAC8?

The following applies if you are a BISON user:

- Ensure your personal details are kept up to date in your BISON account under Account → Profile.

- Provide your tax ID(s) under Tax Information → Tax ID by December 31, 2026 at the latest.

Your German tax ID is an 11-digit number found on your income tax assessment notice or salary tax statement. If you are a tax resident in more than one country, you must provide all relevant tax IDs.

What happens if I do not provide my tax ID?

BISON will remind you in advance to submit your tax ID before December 31, 2026. As a regulated crypto platform in Germany, BISON is legally required to report customer and transaction data to the Federal Central Tax Office (Bundeszentralamt für Steuern, BZSt). Without your tax ID, BISON cannot fully comply with its legal obligations under the DAC8.

DAC8 applies to all regulated crypto exchanges, brokers, and custodians within the European Union, as well as to providers outside the EU that serve customers in the EU. If a user permanently fails to provide their tax ID, BISON may temporarily restrict that user’s access until the tax ID is submitted.

Will my taxes be paid automatically under DAC8?

No. DAC8 only governs the reporting of tax‑relevant data. Your taxes are not automatically deducted. Responsibility for properly declaring and paying taxes on your crypto assets remains with you as the user. Further information can be found in the DAC8 Q&A and in our FAQs (in German only). If you have specific tax‑related questions, you should consult a tax or legal advisor.

Overall, the DAC8 brings greater clarity, transparency, and fairness for crypto investors. By choosing regulated providers and maintaining transparent records of your data and transactions, you benefit from a secure environment and reduce the risk of unpleasant surprises. In this respect, DAC8 represents a major step toward the mainstream adoption of cryptocurrencies.