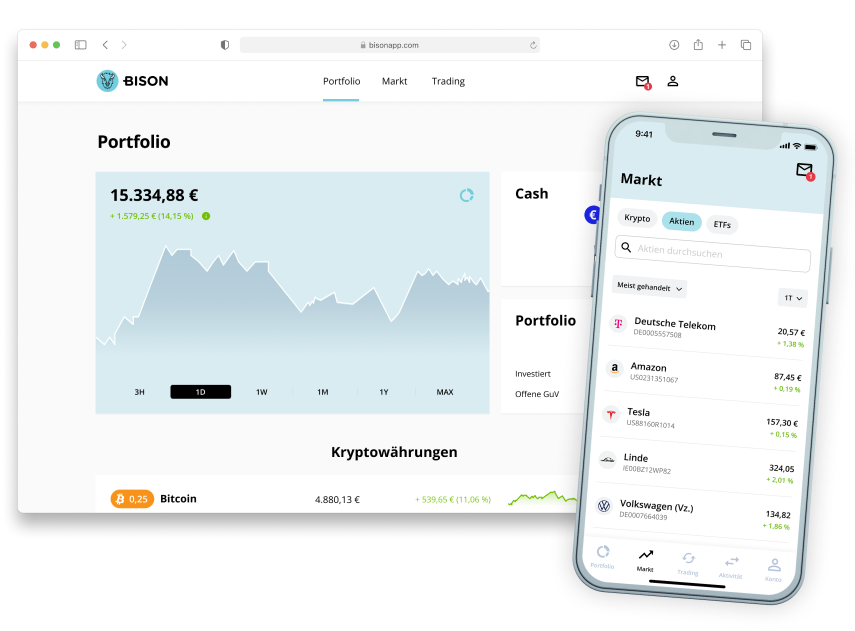

Krypto, Aktien & ETFs

kaufen und verkaufen.

Mit BISON einfach, smart und zuverlässig.

- Kryptowährungen und Wertpapiere auf einer Plattform*

- Gebührenfreier Handel von Kryptowährungen

- Über 770.000 Nutzer vertrauen bereits BISON

- Bitcoin & Co. einfach und sicher verwahren

Bekannt aus TV und Presse

Das passende Investment für Anfänger, Enthusiasten und erfahrene Trader!

Ganz egal, ob du bereits ein Anlageportfolio besitzt oder deine ersten Schritte in der Investment-Welt machst:

Bei BISON findest du die für deine Anlagestrategie passenden Kryptowährungen, Aktien und ETFs.

Dein schneller Einstieg in die Krypto- &

Aktien-Welt

- Registriere dich innerhalb weniger Minuten in der App oder auf unserer Website

- Lass dich bequem per Video-Ident-Verfahren verifizieren und lade Geld auf dein BISON Konto

- Kaufen und Verkaufen in nur 10 Sekunden: Kryptowährungen und Aktien auswählen, gewünschten Betrag eingeben, bestätigen und fertig!

Deine Vorteile beim Trading mit BISON

Einfach

Kostenloses Krypto-Wallet, kostenloses Depot und kein Papierkram – für das Kaufen und Verkaufen von Bitcoin & Co. brauchst du nur einen BISON-Account!

Sicher

BISON legt höchste Priorität auf eine sichere Verwahrung deiner Assets. Z.B. schützen wir die Kryptowährungen durch ein mehrstufiges Sicherheitskonzept und eine integrierte Crime-Versicherung.

Zuverlässig

BISON ist powered by Boerse Stuttgart Group & profitiert von der 160-jährigen Erfahrung im Wertpapierhandel. Zudem hat sie das größte Digital- & Krypto-Geschäft aller Börsengruppen in Europa.

Jetzt kostenlos und risikofrei den Handel von Kryptowährungen im Demo-Modus testen!

Du willst BISON ausprobieren, bevor du in den Kauf und Verkauf von Aave (AAVE), Algorand (ALGO), Bitcoin (BTC), Bitcoin Cash (BCH), Cardano (ADA), Chainlink (LINK), Decentraland (MANA), Dogecoin (DOGE), Ethereum (ETH), Litecoin (LTC), Polkadot (DOT), Polygon (MATIC), Ripple (XRP), Solana (SOL), Shiba Inu (SHIB), The Sandbox (SAND), Uniswap (UNI) und vielen weiteren Kryptowährungen mit Echtgeld einsteigst? Dazu hast du im Demo-Modus die Möglichkeit – mit Spielgeld und ohne Verifizierung. Du bist überzeugt? Dann geht’s im Echtgeld-Modus richtig zur Sache.

Starke und verlässliche Partner für Verwahrung, Liquidität und Banking

Verwahrung

Sowohl über BISON erworbene, als auch eingezahlte Kryptowährungen werden von der Boerse Stuttgart Digital Custody GmbH, einer Gesellschaft der Boerse Stuttgart Group, treuhänderisch verwahrt. Hierfür wurde bei der Boerse Stuttgart Digital Custody GmbH ein mehrstufiges Sicherheitskonzept implementiert.

Handelspartner

Die EUWAX AG, eine Tochter der Börse Stuttgart, ist der Handelspartner für den Kauf oder Verkauf von Kryptowährungen bei BISON.

Banking

Euroguthaben werden kostenlos durch die deutsche Bank Solaris verwahrt und unterliegen dem gesetzlichen Einlagensicherungsfonds bis zu 100.000 Euro pro Kunde.